The Smart Business Owner’s Guide to Contractor Agreements

Contractor or Employee? Fair Work Act 2024 Changes Explained

August 28, 2025Practical Guide to Leasing Commercial Property in Australia

September 8, 2025Do You Owe Super to Your Contractors?

Date published: 27 June 2025 | Author: Nina Rossi

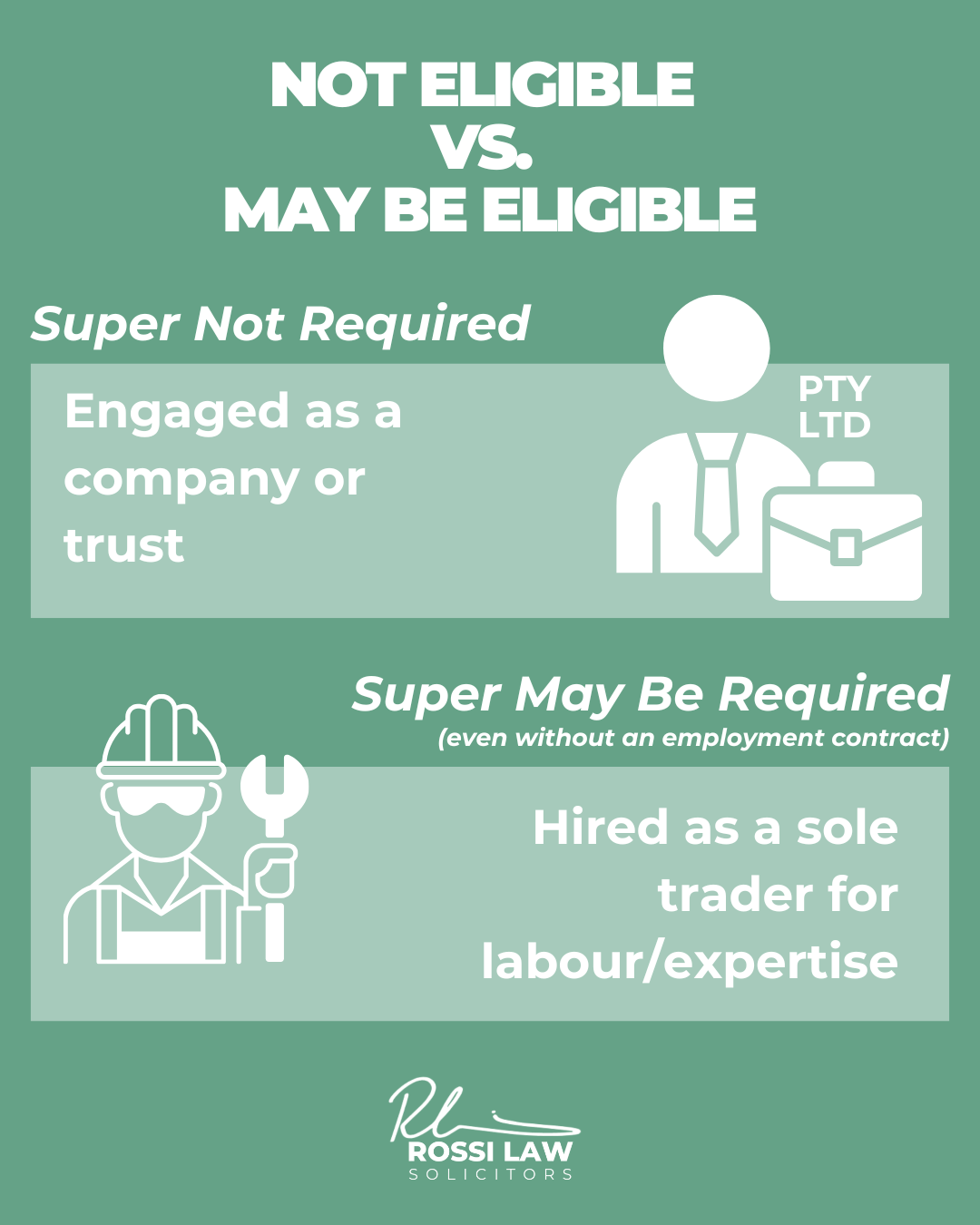

Many business owners assume that contractors take care of their own super. In some cases, that’s true. But if you’re engaging an individual, under a sole trader ABN, to perform work based mainly on their personal skills or labour, the law may treat them as eligible for super, even if they’re called a contractor.

This rule applies when a contractor is hired as an individual and the work relies on their effort or expertise. “Labour” includes non-physical services like design, consulting, administration or technical tasks, provided the person is doing the work themselves.

Super is not usually required when you engage a company or trust. The rule applies when you contract directly with a person, and they are being paid for their labour.

If the arrangement fits this definition, you may be responsible for making super contributions just as if they were an employee. Many businesses are caught off guard by this, especially when no formal employment relationship exists on paper.

It’s worth reviewing your contractor agreements to check whether any of them could fall under this rule. The potential consequences include unpaid super, penalties and interest. Contact Rossi Law today to get the clarity and advice you need to move forward, or explore our Business Law services to learn how we can support your compliance.

This blog is based on a video recorded by Rossi Law. It was first drafted with AI-assistance and reviewed by Rossi Law before publication. It provides general information only and is not legal advice. Please seek advice for your specific situation.